Content

The two other categories of inventory are raw materials (the beginning materials used to manufacture a product) and finished goods (fully assembled products ready to be sold). Knowing how to accurately calculate WIP inventory can impact your balance sheet. If your business offers highly customized products, then it’s important to understand how WIP inventory works, what goes into the cost, and how to calculate it at the end of the accounting period.

Another reason for work in process inventory is safety stock, buffer stock, or anticipation inventory. Some companies find it beneficial to hold on to goods at certain stages of production as insurance https://kelleysbookkeeping.com/ against shortages of supply or spikes in demand. Vendor managed inventory agreements are often helpful in determining the right purchase orders to protect against supply chain surprises.

How do you calculate work-in-progress?

In other words, it’s goods that are in the middle of the production process. Work in process can also be used to refer to the total value of these goods. To clarify where WIP inventory falls in the production process, let’s look at it in the larger context of other inventory classifications.

Unless you’re holding on to a substantial amount of WIP inventory is a part of a strategic anticipatory inventory management strategy. This means BlueCart Coffee Co. has $13,000 worth of inventory that’s neither raw material nor finished goods. For a perishable item like coffee, growing WIP inventory figures are a red flag unless they’re strategically kept as Work In Progress Or Work In Process anticipation inventory. Beginning work in process inventory is actually the same thing as ending work in process inventory, just for a different accounting period. The above work in process inventory definition explains the what, but not the why. This information is educational, and is not an offer to sell or a solicitation of an offer to buy any security.

Finish Your Free Account Setup

Another title for work in process inventory is work in progress inventory (both abbreviated WIP inventory). Similarly to inventory and raw materials, the WIP inventory is accounted for as an asset in the balance sheet. All costs related to the WIP inventory, including the costs of raw materials, overhead costs, and labor costs, need to be considered for the balance sheet to be accurate. Work in process (WIP) inventory refers to materials that are waiting to be assembled and sold.

A general ledger is a master record of all the financial transactions for a company — all monies received and spent are entered. We grow your business by getting you closer to your customers with guaranteed 2-day delivery. Suppose a manufacturer is attempting to calculate its work in progress (WIP) for the end of the latest fiscal year, 2021.

Work in process inventory calculation

WIP inventory includes the cost of raw materials, labor, and overhead costs needed to manufacture a finished product. Any part, product, or item that’s used to make merchandise inventory is listed on a company’s balance sheet. WIP inventory is considered an inventory asset, and as it moves through the stages of production, it becomes part of the cost of sales. The total cost of work-in-progress will also vary from one company to another, and from one industry to another. Some industries are more labor-intensive, while others have a lot of raw materials that go into their products.

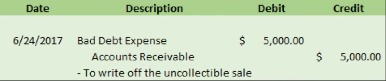

Most companies hire a chief financial officer to maintain these records and avoid costly accounting errors. Keeping tabs on your work in process inventory requires some bookkeeping. If you’re not an accountant, you may wonder how a work in process inventory journal entry looks.

What Is the Difference Between Work in Process and Work in Progress?

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. The formula to calculate WIP is WIP Inventory + Direct Labor Costs + Overhead costs. For example, consulting and manufacturing projects often have custom requirements based on the client. Besides these costs, ABC also incurs manufacturing overheads in the form of worker benefits, insurance costs, and equipment depreciation costs. Once the product has moved past WIP, it is classified as a finished goods inventory.

- For this reason, any underbilling should fall into your asset account for financial reporting.

- This enables production managers to calibrate the output of their assembly line with market vagaries.

- The process and flow of WIP inventory are important to understand because they can indicate how efficient your supplier or manufacturer is at producing finished goods.

- This straightforward explanation of what is WIP (Work in Process) Inventory includes a step-by-step formula and explanation of the place of WIP inventory in the end-to-end supply chain.

Thus, managers can tamp down or increase production based on the availability of materials in bins on the factory floor. The restaurant may also have capital costs like monthly rent (or mortgage) payments for its premises and maintenance on equipment used to make food. Have you heard someone say that something is a ‘work in progress’ or ‘work in process’? We’ll go over that in detail in this article, plus teach you how to use the correct phrase in a sentence. Work in progress and work in process are variants of a noun phrase that means a job or project that isn’t finished yet.

How confident are you in your long term financial plan?

Accountants do not begin tracking depreciation of construction-in-progress assets until the addition is complete and in service. As a result, the construction-work-in-progress account is an asset account that does not depreciate. Understanding WIP inventory is crucial for monitoring and improving production capacity and inventory control.

The contractor has not billed for the line item yet, but has already spent $2,000 in labor costs on the item, and is on schedule (about 40% complete). Work In Progress (WIP) is an accounting concept meaning the value of the work you have completed but have not yet invoiced. In accounting, both phrases refer to the cost of unfinished goods for a business. They might create work-in-progress reports to let the boss know the financial status of their current projects. Work in progress assets are much larger endeavors and may require capitalization if the work in progress investment is not an inventory item.

What is Work in Process (WIP) Inventory?

For this reason, it’s considered best practice to hold as little WIP inventory as possible. What’s more, calculating WIP inventory gives you a clear picture of the health of your supply chain so you can better optimize supply chain planning. Generally speaking, best practice is to carry as little WIP Inventory as possible. Having too much WIP inventory on-hand can be an indication of bottlenecks in your manufacturing or procurement process.

- Companies will generally have their accountant calculate work-in-progress for products not yet completed, so they can accurately include it on their balance sheet.

- Here’s a simple example that shows how records shift from debits to credits throughout the production cycle.

- Most ecommerce businesses rely on a supplier or manufacturer for sellable inventory.

- Construction-in-progress (CIP) accounting is the process accountants use to track the costs related to fixed-asset construction.

It has everything you need to keep your products, customers, and transactions synced and secure, freeing you up to focus on your business. Some companies do a physical count of their WIP inventory to determine the value based on the current stage of each unit in the manufacturing process. This eats up huge amounts of valuable time and distracts your team from doing higher-level work. It comes before the finished goods stage and after the raw materials are moved to the production floor from stores. A WIP report will show a contractor whether they have overbilled or underbilled for any given project. For this reason alone, the WIP report is an essential financial tool for contractors.